Each year, the IRS issues hundreds of thousands of levy notices to taxpayers who fall behind on their taxes. Many don’t realize their bank account or paycheck is at risk until it’s too late. A tax levy is one of the most aggressive collection tools the government uses, allowing them to legally seize wages, bank funds, or property without going to court.

A tax levy can be stopped—and often reversed—with the right legal strategy. At J. David Tax Law, we’ve helped clients get wage garnishments released in as little as 48 hours. If you’re facing a levy, our attorneys can help you protect your income and regain control quickly.

What Is a Levy?

A levy is an official act by a government or authority to impose or collect something, most commonly money, property, or resources. It may involve the imposition of a charge (such as a tax or fine) or the enforcement of collection when payment is not made. Levies are used in different contexts: a government may levy a tax, a court may levy a fine, or an agency may levy property to settle a legal debt.

In historical and legal terms, a levy doesn’t always involve taking assets. It can also mean the formal declaration of something, such as a military levy (drafting troops) or a levy of duties (trade or customs). The unifying idea is compulsion backed by legal authority: a levy is not a request, but an enforced obligation.

Difference Between a Levy and a Tax Levy

A levy is a general legal term that refers to any official act of imposing, assessing, or collecting an obligation such as taxes, fines, or even military drafts. It’s a broad concept that applies to many enforcement contexts.

A tax levy, however, is a specific and aggressive collection action. The tax levy meaning refers to the legal seizure of a taxpayer’s assets—such as wages, bank accounts, or property—to satisfy unpaid tax debt. This can be carried out by the IRS or by a state tax authority. An IRS tax levy is issued by the federal government, typically after multiple ignored notices. A state tax levy operates similarly but is governed by state-specific rules, timelines, and enforcement powers.

In practice, tax levies are often the step taken after a tax lien has already been filed, serving as the government’s escalation from notice to direct enforcement.

The IRS is Forgiving Millions Each Day. You Could Be Next.

Understanding Tax Levy Types: IRS and State Collection Methods

A tax levy is not one-size-fits-all. The IRS and state tax authorities use several different collection methods to enforce unpaid tax liabilities. Each type of levy targets specific assets and follows a legally defined process. Understanding the types of tax levies can help you identify the risks and take action before permanent financial damage occurs.

🔹 Wage Garnishment (Wage Levy)

🔹 Bank Account Levy

A bank levy allows the IRS or state tax authority to freeze and seize funds directly from your checking or savings account. Once the levy is issued, your bank is required to hold the funds for 21 days (in the case of the IRS), after which the money is transferred to the government unless resolved. State tax levies may offer shorter notice periods and fewer protections.

J. David Tax Law has helped thousands of clients across all 50 states resolve levy issues and protect their assets. To learn more about our services, visit https://www.jdavidtaxlaw.com/

🔹 Property Seizure

🔹 Social Security and Federal Payment Levies

Under the Federal Payment Levy Program (FPLP), the IRS can levy a portion of your Social Security benefits, federal contractor payments, and other government-issued income. This is a powerful tool used for recurring enforcement on federal disbursements.

🔹 1099 and Business Account Levies

🔹Other Asset Seizure

Beyond standard levies on wages and bank accounts, the IRS and state tax authorities may seize a variety of other financial assets to collect unpaid tax debt. This includes investment accounts such as brokerage portfolios and mutual funds, which can be liquidated to cover tax liabilities. Retirement assets, including 401(k)s, IRAs, and pension distributions, may also be subject to seizure, especially once funds become accessible. In addition, life insurance policies with cash value, like whole or universal life plans, can be levied by claiming their cash surrender value. These types of asset seizures often come as a surprise to taxpayers who assume these resources are protected—but in reality, they’re fully within the government’s enforcement reach once a levy is in place.

When Does the IRS Issue a Tax Levy? A Step-by-Step Look at the Process

The tax levy process is structured, legally regulated, and designed to give taxpayers multiple opportunities to resolve their debt before asset seizure occurs. Here’s how the process typically unfolds:

1. Tax is Assessed and Payment is Demanded

The process begins when the IRS assesses a tax liability — whether from a filed return, an audit, or a substitute for return (SFR). The IRS then sends a Notice and Demand for Payment, which is a formal request for the taxpayer to pay the balance due.

2. Taxpayer Fails to Pay or Respond

If the taxpayer does not pay the tax or make arrangements to resolve the debt, the account becomes delinquent. At this point, the IRS may begin collection efforts. However, before a levy is issued, additional notices must be sent.

3. Final Notice of Intent to Levy Is Issued

Before a levy can occur, the IRS must issue a Final Notice of Intent to Levy and Notice of Your Right to a Hearing. This is typically done through Letter 1058 or Letter 11. This notice is either mailed to your last known address or hand-delivered.

4. 30-Day Waiting Period

After the Final Notice is issued, the IRS must wait 30 calendar days before initiating a levy. This window gives the taxpayer time to request a Collection Due Process (CDP) hearing, propose a resolution, or dispute the levy action.

If you’ve received a Final Notice of Intent to Levy, you still have time to take control, but the window is limited. Call (888) 342-9436 to speak with our tax attorney who’s handled this before.

5. Levy Issued

If no action is taken within the 30-day period, and no formal resolution is in place, the IRS may move forward with issuing a tax levy. This can result in wage garnishment, bank account seizure, asset seizure, or recurring levies on Social Security or contractor payments.

6. Continued Enforcement Until Resolved

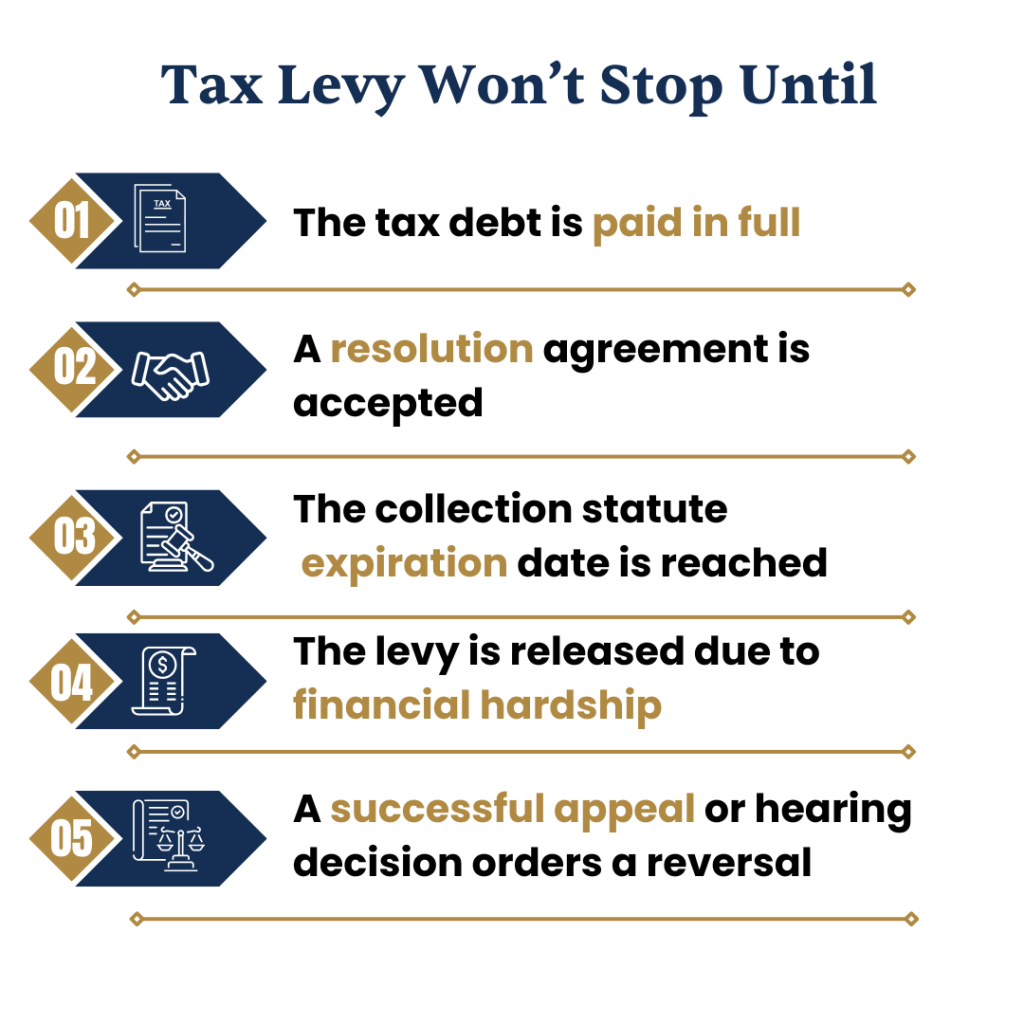

Once in place, a levy remains active until the debt is paid, the statute of limitations expires, or the IRS agrees to release or modify it due to hardship or a successful appeal.

Ways to Stop a Tax Levy Before It’s Too Late

Once the IRS issues a Final Notice of Intent to Levy, you typically have only 30 days to act before they begin seizing your wages, bank funds, or other assets. Fortunately, there are several proven ways to stop a tax levy, but each option requires timely action and often professional guidance. Here’s how to protect yourself before enforcement begins:

1. Collection Due Process (CDP) Hearing

If you receive a Final Notice of Intent to Levy (Letter 1058 or Letter 11), you have the right to file Form 12153 within 30 days to request a Collection Due Process hearing. This pauses levy action while your case is reviewed. You can dispute the debt, propose an alternative resolution, or challenge the levy based on hardship or procedural errors.

🔹 This is one of the most effective ways to stop a levy fast—if done within the 30-day window.

2. Enter Into an Installment Agreement

A payment plan with the IRS (called an Installment Agreement) allows you to repay your tax debt in monthly installments. Once the agreement is approved, the IRS is typically required to release any active levy and halt further enforcement, provided you remain current on payments.

🔹 Even partial payments can qualify if you meet compliance requirements and apply before the levy starts.

3. Submit an Offer in Compromise (OIC)

If you can’t afford to pay the full tax debt, you may qualify for an Offer in Compromise, which settles your liability for less than the total owed. While the IRS reviews your offer, levy actions are temporarily suspended. A well-prepared OIC backed by accurate financial documentation can lead to substantial debt reduction. In our recent case, Kenneth J. owed $1,622,404, but the IRS accepted an offer of just $60,300 — eliminating over $1.56 million in debt.

🔹 Eligibility depends on your financial situation, and a strong, well-documented submission greatly improves success.

4. Qualify for Currently Not Collectible (CNC) Status

If you’re facing serious financial hardship such as unemployment, medical issues, or low income — you may request Currently Not Collectible (CNC) status. If approved, the IRS temporarily halts collection efforts, including active and future levies.

🔹 While the debt still exists, CNC status protects your income until your financial situation improves.

5. Pay the Tax in Full or Through a Third-Party Loan

Paying the balance in full will immediately stop the levy and resolve your tax case. In some cases, taxpayers use home equity loans, personal loans, or business funding to eliminate the debt and avoid further penalties or seizures.

🔹 If you’re close to the statute of limitations (10-year CSED), speak with our tax attorneys before paying in full.

6. File for Innocent Spouse Relief

If the levy is due to a spouse’s or ex-spouse’s error, you may be eligible for Innocent Spouse Relief. Filing Form 8857 can delay or stop levy actions while the IRS investigates your claim.

🔹 This relief is especially important in cases of divorce, abuse, or hidden income.

7. Prove the Levy Is Causing Economic Hardship

If a levy creates immediate financial hardship such as inability to pay rent, utilities, or buy food, you can request an expedited levy release under IRC § 6343(a)(1)(D). You’ll need to show documentation of your income, expenses, and hardship.

🔹 Even if the levy is legal, the IRS is required to release it if it jeopardizes your basic living needs.

Conclusion

A tax levy is one of the most severe actions the IRS or state can take and it often happens after multiple warnings go unanswered. Whether it’s your wages, bank accounts, or business income at risk, the key to stopping a levy is taking action early and strategically. But you have options, and in many cases, the levy can be released, reduced, or avoided entirely with the right legal guidance.

At J. David Tax Law, our tax lawyers helped countless clients protect their income, remove levies, and resolve massive tax debts, sometimes settling for just a fraction of what was owed. If you’ve received a levy notice or fear one is coming, don’t wait for the IRS to take more. Let us help you take control, protect your future, and put this behind you, for good.

Frequently Asked Questions

Yes, the IRS can garnish your wages through a wage levy if you have unpaid federal tax debt and fail to respond to notices. They will notify your employer, who is legally required to withhold a portion of your paycheck and send it directly to the IRS until the debt is resolved. For more information read our detailed article on How to Stop the IRS from Garnishing Your Wages.