When you file a joint tax return, both spouses share equal responsibility for any taxes owed. This includes liability for errors, omissions, or underreporting, even if only one spouse was responsible.

To address this, the IRS established the Innocent Spouse Relief program, which can release an individual from joint liability under certain conditions. The program recognizes four categories of relief: Innocent Spouse Relief, Separation of Liability Relief, Equitable Relief, and Relief from Liability Arising from Community Property Law.

Although the program provides a path to relief, obtaining approval is challenging. The IRS applies strict criteria, enforces deadlines, and often requires extensive documentation. As a result, many applications are denied each year.

Want to know the most common pitfalls that lead to the denial of Innocent Spouse Relief? Keep reading!

Key Takeaways

- Many Innocent Spouse Relief applications are denied each year due to strict IRS requirements.

- The most common reasons for denial are lack of eligibility, missing documents, late filing, or inconsistent information.

- Taxpayers can respond by reviewing the denial letter, correcting documentation gaps, and filing an appeal within 90 days.

- An appeal with IRS Form 12509 may overturn the decision if supported with strong evidence.

- Other IRS programs such as Injured Spouse Relief, Offer in Compromise, Installment Agreements, CNC status, or Penalty Abatement may provide relief.

A qualified tax attorney can strengthen your case and improve the chances of success.

Key Factors Leading to Innocent Spouse Relief Denial

Don’t let the denial of your Innocent Spouse Relief application discourage you. The fact that only 4,807 out of 26,179 applicants in 2021 were accepted shows how complex this process can be. Let’s break down some of the common reasons why applications get denied and what you can do about it.

Form 8857 must be filed within the statutory timeframe. Missing this deadline can result in automatic denial, regardless of the strength of your claim.

Click here to learn about the various types of Innocent Spouse Relief and the eligibility criteria.

Steps to Take After Innocent Spouse Relief Is Denied

When the IRS denies your request for relief, it involves a combination of understanding the reasons and knowing how to respond effectively. Here are some simple tips to guide you:

1. Reviewing the Denial Letter

If your application is denied, the IRS will send you a denial letter (Notice of Determination) that explains why. It’s important to read this letter carefully because it tells you exactly what the IRS thought was missing or wrong with your application. Understanding these points can help you figure out what to fix if you decide to apply again or appeal the decision.

- Identify Key Issues: Make note of each reason the IRS provides. These reasons often pinpoint the exact areas where your application failed to meet IRS criteria.

- Documentation Gaps: Look for any mentions of insufficient documentation. Perhaps more detailed financial records or additional evidence could sway the decision.

- Misunderstandings or Errors: Sometimes, denials result from misunderstandings or incorrect information. Identifying these can be crucial for an effective appeal.

2. Administrative Guidance

The IRS provides guidelines, like the ones in Form 8857, on how to apply for Innocent Spouse Relief. Looking over these guidelines can help you understand what information and documents you need to provide to meet the IRS’s expectations.

- Checklist of Requirements: Form 8857 outlines specific requirements and documentation needed. Ensure you follow this checklist precisely to avoid missing critical pieces of information.

- Examples and Scenarios: The form and guidelines often include examples that can help you understand how to present your situation clearly and effectively.

- Updates and Changes: Tax laws and IRS guidelines can change. Always check that you are using the most current forms and instructions to ensure compliance with the latest rules.

3. Interpreting the IRS’s Explanation

The language used in IRS letters often includes complicated legal terms that can be challenging to understand. If you find yourself confused by the details in these communications, consulting with a tax expert can be incredibly helpful. An A+ rated tax professional like J. David Tax Law, with a collective experience of over 40 years, can help clarify these complex explanations and guide you on the best steps to take next.

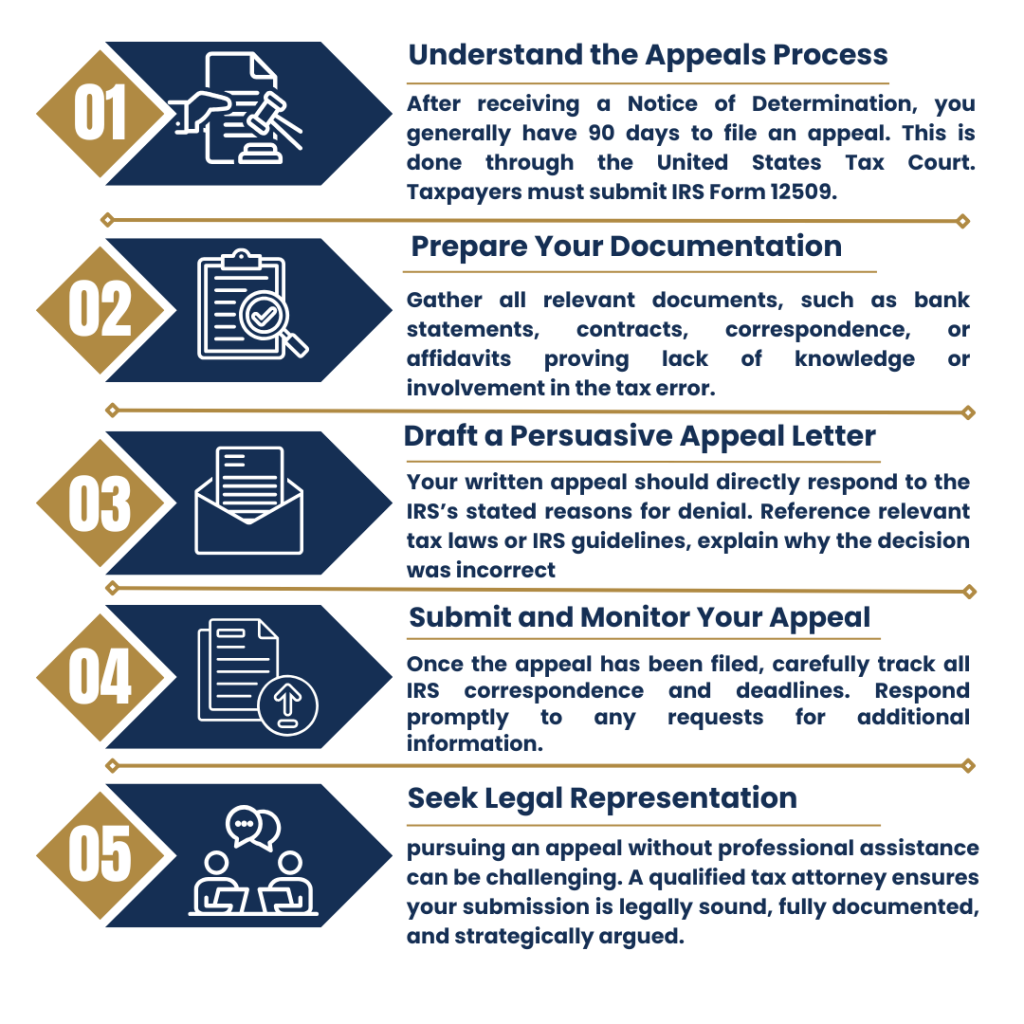

Appeal Innocent Spouse Determination

If your application for Innocent Spouse Relief has been denied by the IRS, it’s not the end of the road. You have the opportunity to challenge this decision (appeal the IRS decision) and potentially overturn it. Here’s how you can start the process of challenging your Innocent Spouse Relief denial to seek a fair resolution.

Remember

Tax laws can be complex, and having one of our tax attorneys assist you can make a significant difference—with an absolutely free initial consultation. They can ensure your appeal is well-prepared, adheres to all legal guidelines, and presents a strong argument on your behalf.

Innocent Spouse Relief vs. Injured Spouse Relief

Understanding the Difference

Taxpayers often confuse Innocent Spouse Relief with Injured Spouse Relief, but the two programs serve very different purposes. Understanding the distinction is essential when determining the correct option for your situation.

Innocent Spouse Relief

This form of relief applies when one spouse seeks protection from liability arising from errors, omissions, or understatements on a joint tax return. Approval requires demonstrating that you did not know, and had no reason to know, about the inaccuracies. If granted, you may be released from responsibility for the tax debt created by your spouse or former spouse.

Injured Spouse Relief

By contrast, Injured Spouse Relief is designed to protect your share of a joint tax refund from being applied to your spouse’s separate debts, such as past-due federal taxes, state taxes, child support, or federal student loans. To request this relief, you must file IRS Form 8379, Injured Spouse Allocation. If approved, the IRS will allocate your portion of the refund separately, ensuring that it is not used to pay your spouse’s obligations.

Key Distinction

- Innocent Spouse Relief: Protects against liability for tax debts caused by a spouse’s errors on the joint return.

- Injured Spouse Relief: Protects your rightful share of a refund from being applied to your spouse’s personal debts.

Choosing the correct type of relief is important. Filing for the wrong program can result in unnecessary delays or automatic denial. Consulting a qualified innocent spouse relief attorney ensures that your case is evaluated accurately and pursued under the appropriate relief provision.

Alternative Tax Relief Options

With our expert tax specialists on your side, your appeal is set up for success, greatly reducing the likelihood of denial. However, if it’s denied for any reason, or if you choose to explore alternatives, there are several other tax relief options available to help manage your tax liabilities effectively. Understanding these alternatives can provide you with viable pathways to resolve your tax issues in a way that fits your financial situation. Here’s a detailed look at some common tax relief strategies and how to determine the best choice for your circumstances:

Offer in Compromise (OIC)

This option allows you to settle your tax debts for less than the full amount owed, providing a significant financial relief if you meet the IRS criteria. The process involves submitting a proposal to the IRS that outlines how much you can pay. The IRS will consider your income, expenses, asset equity, and ability to pay when evaluating your proposal. An OIC is ideal for those who cannot pay their full tax liabilities without causing financial hardship. See how our tax law firm can help you settle your IRS tax debt for less than the full amount owed through effective negotiation with an Offer in Compromise.

Installment Agreement

If you’re unable to pay your tax debt in full, you may qualify for an Installment Agreement with the IRS, which allows you to make monthly payments over time. This is one of the most commonly used tax relief options and can be arranged for a period that reflects your ability to pay. It’s suitable for individuals who can meet regular payment obligations but need an extended timeframe to clear their tax dues. Check if you’re eligible for an IRS installment agreement and reset your financial status with the IRS through our Fresh Start Program.

Currently Not Collectible (CNC)

If paying your back taxes would prevent you from covering basic living expenses, you might qualify for Currently Not Collectible status. Under CNC, the IRS temporarily halts collection activities until your financial situation improves. This doesn’t waive the tax owed but provides relief from the pressure of immediate payments. See how our tax debt attorneys can delay IRS collection actions due to financial hardship with Currently Not Collectible status.

Penalty Abatement

If you have a reasonable cause for not meeting tax obligations, such as illness or natural disaster, you might qualify for penalty abatement. This relief option can reduce or remove penalties associated with failing to file or pay taxes on time, helping to lower your overall tax debt.

Did you know J David Tax Law helped secure a full waiver of $150,888 in penalties and interest for one of its clients, Ryan, through this penalty abatement program?

To decide which tax relief strategy is best for your situation, consider your current financial status, the total amount of tax debt, and your future income potential. It’s also wise to consult with a tax professional who can offer personalized advice based on a detailed assessment of your circumstances.

Preventive Measures for the Future

Dealing with tax issues can be stressful and time-consuming. To help prevent similar challenges in the future, it’s important to adopt proactive strategies when filing taxes and managing finances. Here are some effective tips and resources to help you stay on top of your tax responsibilities and avoid potential problems:

If your Innocent Spouse Relief application has been denied, don’t worry — we’re here to help. Call us at (888) 342-9436 for a free consultation, and we’ll explore every possible option to address your situation.

Frequently Asked Questions:

A tax attorney can review the denial, explain applicable IRS rules, and prepare a strong appeal with supporting documentation.

When appealing an Innocent Spouse Relief denial, a tax attorney provides critical guidance. They review the IRS’s reasons for denial, identify weaknesses in your case, and ensure compliance with all procedural deadlines. Attorneys also organize and submit financial records, correspondence, and affidavits that strengthen your position. In addition, they draft the appeal letter, cite relevant tax laws, and represent you in communications with the IRS or Tax Court, greatly improving your likelihood of success.