Many people worry they’ve committed tax evasion just because they filed late or underpaid their taxes. But not all tax problems equal criminal activity. There’s a big difference between honest mistakes and deliberate fraud.

Tax evasion is a willful act. It happens when someone knowingly hides income, overstates deductions, or fails to file returns to avoid paying what they owe. Forgetting to report a 1099 once or making a math error may result in penalties, but it doesn’t usually mean the IRS sees you as a criminal.

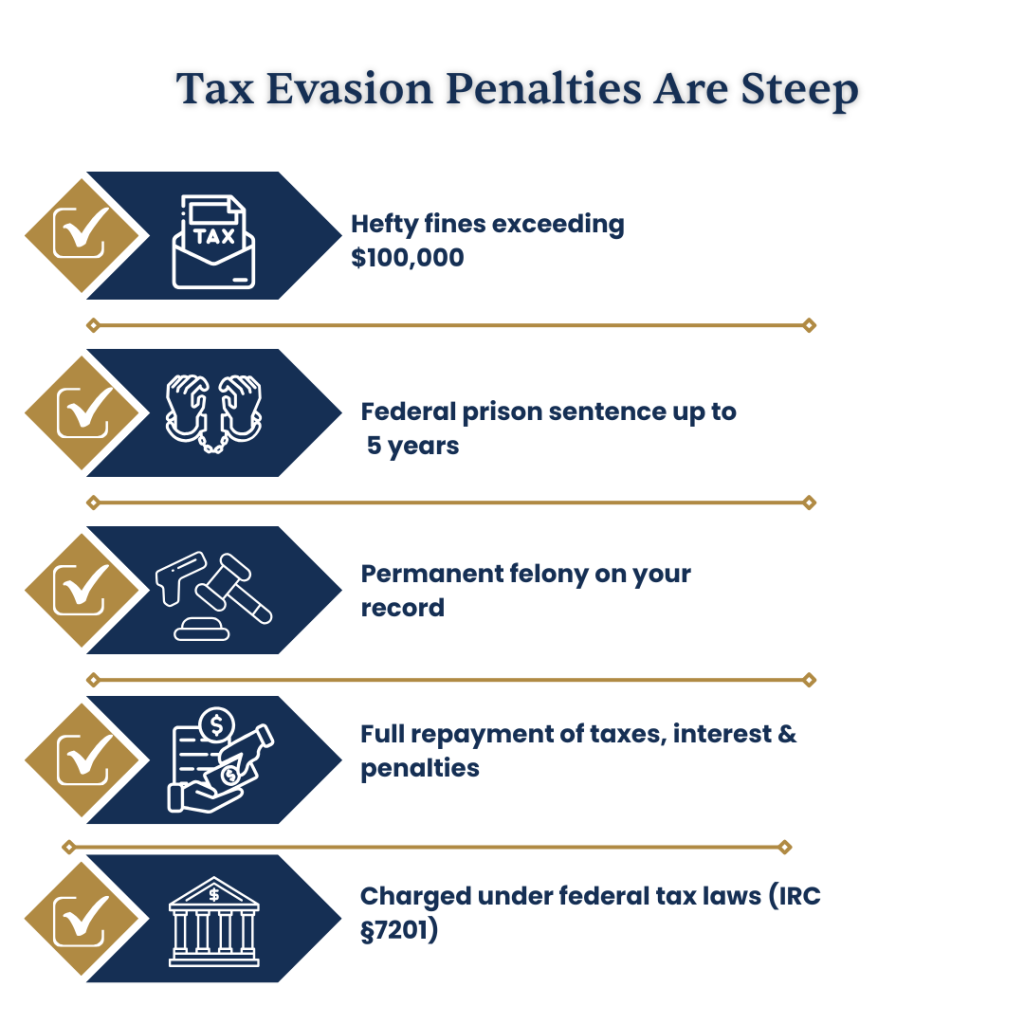

That said, when intent is involved, the consequences escalate quickly. The IRS can pursue felony charges, impose hefty fines, and even send offenders to federal prison. Convictions under IRC §7201 or §7206 can lead to years behind bars and six-figure penalties.

This guide breaks down exactly what qualifies as tax evasion, the red flags the IRS looks for, and how to avoid crossing the line from civil error to criminal liability. Whether you’re trying to correct past filings or wondering if you’re at risk, understanding how the IRS defines tax evasion is the first step to protecting yourself.

What Is Tax Evasion?

Tax evasion is the intentional act of avoiding tax payment through deception. It is not the same as making an honest mistake or filing late due to oversight. The IRS defines tax evasion under 26 U.S. Code § 7201. It applies when someone willfully attempts to evade or defeat a tax that is legally owed.

This is a felony-level offense. If convicted, you could face up to five years in prison, hefty fines, and still owe the full amount in taxes plus interest and penalties. Tax evasion differs from legal tax avoidance. Using deductions and credits within the law is allowed. Lying about income or falsifying records crosses the line into evasion.

Some of the most common forms include underreporting income, especially cash earnings, or failing to file returns altogether. Others include claiming fake deductions, concealing assets, or moving money offshore without disclosure.

Businesses can also be charged. This may happen when revenue is hidden, expenses are inflated, or payroll taxes are not paid. The IRS investigates these crimes through its Criminal Investigation Division (CI). They review bank records, tax filings, and financial statements to detect fraud.

Even if the IRS doesn’t prosecute every case, willful actions to hide income or avoid tax liability increase the risk of criminal penalties.

Common Red Flags That Could Signal Tax Evasion

The IRS doesn’t criminally charge taxpayers over simple math errors. But certain patterns in your return or lack of one can trigger an audit, and in some cases, a criminal investigation.

Here are some of the most common red flags that raise suspicion of intentional evasion:

Unreported Cash Income

Industries that operate heavily in cash like salons, restaurants, or gig-based work, often attract IRS attention. When cash earnings aren’t documented and your declared income doesn’t align with your lifestyle, the IRS may flag the discrepancy. Gaps between visible spending (like real estate or vehicles) and reported earnings can raise serious concerns about unreported income.

Inconsistent or Missing Returns

Filing tax returns erratically, skipping years, or reporting wildly different income from year to year without a valid explanation can trigger further scrutiny. The IRS uses automated systems to flag unusual return histories and may initiate a compliance review or audit.

Inflated or Unsupported Charitable Deductions

Claiming large donations without proper documentation can invite trouble. If the amounts seem disproportionate to your income, or if you’re reporting non-cash gifts without qualified appraisals, it may be seen as an attempt to falsely reduce taxable income.

Fictitious Business Expenses

Some taxpayers fabricate expenses to reduce self-employment or small business tax. This includes creating fake vendor payments, inflating mileage logs, or listing personal expenses, like vacations or clothing, as business-related. The IRS often cross-checks deductions against actual bank records or 1099s from contractors.

Hidden Offshore Accounts

Failing to report foreign bank accounts or assets is a serious offense. U.S. taxpayers are required to file FBAR and Form 8938 if their foreign financial holdings exceed certain thresholds. Undisclosed offshore holdings can result in both civil penalties and criminal prosecution.

Undisclosed Cryptocurrency Transactions

The IRS treats crypto as property, not currency. Selling, trading, or earning cryptocurrency must be reported even if the exchange didn’t issue a 1099. Omission of digital asset income is now tracked more aggressively through third-party subpoenas to platforms like Coinbase and Kraken.

Falsified Records or Documents

Submitting false receipts, altering invoices, or fabricating supporting documents isn’t just a tax issue, it’s criminal fraud. The IRS considers falsification as clear evidence of willful misconduct, and it’s often a core part of tax evasion prosecutions.

What Happens If You’re Investigated for Tax Evasion?

When the IRS suspects a taxpayer has willfully committed fraud, the matter can escalate into a criminal investigation. These cases are handled by the IRS Criminal Investigation Division (CID), a federal law enforcement branch tasked with uncovering deliberate tax crimes.

The process begins quietly. If your case is selected, you might receive a subpoena for financial records, or in more serious instances, be approached directly by IRS Special Agents. This contact is not part of a standard audit; it’s an indication that you’re the subject of a criminal review.

Once active, CID investigators conduct a forensic financial audit, analyzing years of tax filings, income, asset transfers, bank activity, and even third-party statements. Their goal is to build a case showing intent to deceive, not just accidental underreporting.

If investigators find enough evidence, your case may be referred to the Department of Justice (DOJ) for prosecution. At that stage, formal criminal charges may follow.

Common Charges in These Cases

- Tax fraud

- Submitting false returns or statements

- Wire fraud or mail fraud if tax-related documents were transmitted electronically or by mail

Potential Penalties

- Up to 5 years in federal prison per offense

- Fines over $100,000, plus prosecution costs

- Restitution of unpaid taxes, penalties, and interest

- A permanent felony conviction, which may affect licenses, credit, and future tax treatment

The IRS is Forgiving Millions Each Day. You Could Be Next.

Difference Between Tax Fraud and Tax Evasion

Tax fraud and tax evasion are often confused, but the IRS treats them differently and so should you. While both involve willful violations of tax law, they target different behaviors and carry different legal risks. Understanding these definitions helps determine whether you’re facing a civil mistake or a felony-level charge.

Tax Fraud

Tax fraud is a broad category that refers to knowingly providing false information to the IRS. It can involve inaccurate returns, identity misuse, or fabricated claims all intended to reduce what you owe or inflate a refund.

Examples include:

- Submitting returns with knowingly false information

- Using a false or stolen Social Security number

- Claiming dependents that don’t exist

- Participating in tax-related identity theft or refund fraud schemes

Tax Evasion

Tax evasion is a specific felony offense under IRC §7201, where someone knowingly hides income or avoids paying taxes they legally owe. Unlike fraud, evasion typically centers around concealment, not false identities or claims.

Examples include:

- Deliberately failing to include earnings from side jobs or contract work

- Using offshore or hidden accounts to avoid disclosure

- Exaggerating deductions or business losses

- Failing to file returns with the intent to hide income

Can You Go to Jail for Tax Evasion?

Yes, tax evasion is a criminal offense, and prison is a real possibility. While not every case results in incarceration, the IRS pursues jail time when it sees clear signs of willful deception, especially if the amount owed is high or the behavior is repeated over several years.

The IRS doesn’t just collect taxes, it prosecutes offenders to send a message. If you intentionally underreport income or conceal assets, you may be referred for criminal charges.

How to Avoid Being Accused of Evasion

The best defense against an IRS investigation is prevention. Many tax evasion cases begin with avoidable mistakes, missed filings, poor recordkeeping, or underreported income. By staying organized and honest, you reduce the chances of being flagged for potential fraud.

If you’ve made errors in the past, the IRS is often more lenient when you take action before they do. Here’s how to protect yourself:

- File every return, every year: Even if you can’t pay, always file. Unfiled returns raise immediate red flags with the IRS.

- Maintain accurate records: Keep receipts, bank statements, income logs, and all supporting documentation for at least three years.

- Report all sources of income: Digital income must be included, even from trading platforms.

- Be truthful with deductions and credits: Avoid padding expenses, inflating charitable donations, or listing dependents you don’t support.

- Consult a tax attorney for complex issues: If you’re unsure how to handle a tax matter or have a large balance, the right legal advice can prevent mistakes from turning into criminal cases.

- Use the IRS Voluntary Disclosure Program if needed: If you’ve underreported income or failed to file, correcting it before the IRS contacts you may reduce penalties or avoid prosecution entirely.

What to Do If You Think You Committed Tax Evasion

If you believe your past tax filings could raise red flags, don’t try to fix them yourself. Filing amendments or contacting the IRS without legal guidance can trigger an audit, or worse, a criminal investigation.

Your best move is to speak with a tax attorney before taking any action. A qualified lawyer can assess your filings, identify risk, and recommend the safest way forward. In many cases, early legal help can prevent charges from being filed at all.

J. David Tax Law® offers free, confidential consultations for individuals worried about tax exposure. You’ll work directly with a licensed attorney who knows how to resolve these issues quickly. Call (888) 789-5011 before the IRS takes the next step.

Conclusion

Tax evasion carries harsh penalties, but it’s only criminal when the IRS can prove you acted intentionally. Honest mistakes, like math errors or missing forms, usually lead to civil consequences not prison.

If you’re unsure where your situation falls, don’t guess. A licensed tax attorney can review your case, explain your risks, and help you take corrective action before the IRS takes control.

Getting ahead of the problem is key. If you think your past filings could raise questions, now is the time to act not after you get a subpoena.

Frequently Asked Questions

What is considered tax evasion by the IRS?

Can you go to jail for tax evasion?

Is tax evasion a felony?

How does the IRS catch tax evaders?

The IRS uses audits, third-party reporting, and its Criminal Investigation Division (CID) to identify tax evasion. Red flags include unreported income and fake deductions.