Innocent Spouse vs. Injured Spouse: What’s the Difference — and Why It Matters

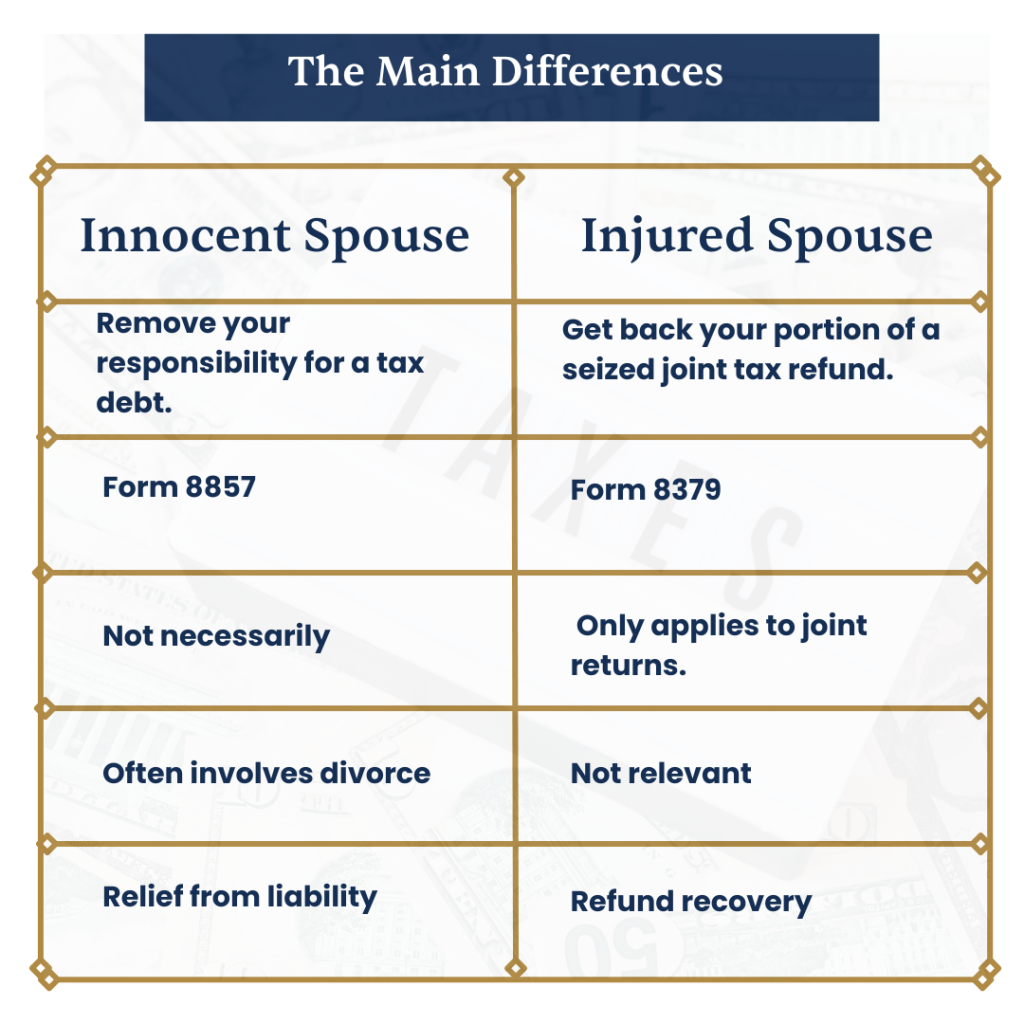

The two sound alike, but they address very different tax problems. Injured spouse relief lets you reclaim your share of a joint refund if it’s being taken to cover your spouse’s debts, such as back child support or student loans. Innocent spouse relief, on the other hand, can remove your responsibility for tax debt caused by your spouse’s errors or omissions on a joint return.

Mixing them up can delay your refund or leave you on the hook for taxes you don’t truly owe. This guide explains the key differences, how each relief option works, and when to use them to protect yourself.

The IRS is Forgiving Millions Each Day. You Could Be Next.

What Is Innocent Spouse Relief?

Innocent spouse relief protects you when the IRS says you owe taxes because of something your spouse (or ex-spouse) did, but without your knowledge.

Let’s say you filed a joint return, but your spouse underreported income, claimed false deductions, or didn’t pay the full amount owed. If the IRS audits that return years later, they’ll try to collect the full balance from both of you. That’s where innocent spouse relief comes in.

Again, it applies to joint returns where:

- Income was hidden

- Deductions were overstated

- The tax wasn’t paid in full

To request this protection, you must file Form 8857 to report your situation and request relief from the tax liability. If you’re experiencing a difficult joint tax liability case, seasoned tax professionals, like J. David Tax Law, can provide free consultation to discuss solid relief options.

There are mainly three types of innocent spouse relief, each with different requirements:

Classic Innocent Spouse Relief

This type of innocent spouse relief applies when the IRS discovers that your joint return understated income or claimed improper deductions, and you didn’t know about it. You must prove that it would be unfair to hold you responsible, especially if you didn’t benefit from the error.

For instance, your spouse failed to report freelance income, and years later, the IRS sends you a bill. If you truly didn’t know, and your financial situation supports it, you could qualify for relief.

Separation of Liability Relief

This option splits the tax bill between you and your spouse (or ex-spouse). It’s only available if:

- You’re divorced, legally separated, or haven’t lived together for 12 months

- The error was solely your spouse’s fault

- You’re still responsible for your share of the tax, but not theirs.

Equitable Relief

This is the most flexible form of relief used when you don’t qualify for the other two, but the IRS agrees it would be unfair to collect the debt from you.

For example, perhaps the tax was paid late, not due to fraud, but because your spouse controlled all the finances. If you’re now separated and struggling to pay, the IRS might still grant relief under fairness rules.

What Is Injured Spouse Relief?

Injured spouse relief helps protect your share of a joint tax refund when it’s taken to pay your spouse’s past-due debts. This relief applies if you filed jointly, but your portion of the refund was unfairly withheld for things like:

- Federal student loans

- Child support

- Past-due federal or state taxes

In these cases, the IRS doesn’t care whose income created the refund, so they’ll apply the full amount to your spouse’s debt unless you request this relief.

To claim it, you must file Form 8379, also known as Injured Spouse Allocation. The IRS will then review your income and withholdings separately to return your fair share of the refund.

Note: This is completely different from innocent spouse relief. Injured spouse relief isn’t about tax liability, but getting your money back when your spouse’s debts interfere.

Innocent Spouse vs. Injured Spouse Relief: What’s the Difference?

While they sound similar, innocent spouse relief and injured spouse relief serve very different purposes.

Why Understanding the Difference Between Innocent and Injured Spouse Relief Matters

As we’ve pointed out earlier, the difference between innocent spouse and injured spouse relief goes beyond tax forms and can directly impact your financial security. If you file the wrong form or misunderstand which relief applies to your situation, you could lose a refund you were counting on or end up on the hook for a tax debt that isn’t truly yours.

When injured spouse relief is overlooked, the IRS may apply your portion of a joint refund toward your spouse’s unpaid federal debts, such as past-due child support or student loans. That money is gone unless you properly file Form 8379 and claim your share.

On the other hand, if you’re dealing with tax understatements or fraud committed by your spouse or ex-spouse, failing to pursue innocent spouse relief can leave you liable for the entire tax bill, along with penalties and interest, even if you didn’t know about the issue when signing the return.

Knowing the difference helps you protect your share of any refund, stay compliant with IRS requirements, and avoid costly mistakes that can have long-term legal and financial consequences.

Get Justice With The Right Spousal Relief Option

Whether you’re trying to recover a portion of your refund or shield yourself from a tax debt you didn’t cause, it’s essential to understand which IRS program fits your situation. Choosing the wrong path could cost you time, money, and legal protection.

If you’re unsure which applies to you, it’s worth getting a case review before taking your next step.

Contact J. David Tax Law for a free consultation and personalized guidance.