Marriage and Tax Debt: Do You Inherit Your Spouse’s Debt?

Not automatically, but depending on how you file and where you live, you could still be affected. If your spouse owes back taxes, the IRS may seize joint refunds, place liens on shared property, or issue levies that impact your household finances.

The rules differ if you file jointly, live in a community property state, or keep finances separate. That’s why understanding how tax debt works in marriage is essential for protecting your income and credit.

This guide explains when you are (and aren’t) responsible for a spouse’s tax debt, the risks you face, and the legal relief options available to protect yourself.

To talk to a professional about your situation, get a free consultation from J. David Tax Law Innocent Spouse Relief service.

The IRS is Forgiving Millions Each Day. You Could Be Next.

When You Might Be Responsible for Your Spouse’s Debt

While marriage alone doesn’t automatically make you liable for your spouse’s debt, there are a few key situations where you could be held responsible:

1. Joint Accounts or Co-Signed Loans

Filing jointly offers tax benefits but it also means joint and several liability. That’s legal speak for: if you file together, the IRS can come after either spouse for the full amount, regardless of who caused the problem.

Even if only one partner had underreported income or failed to pay, both are on the hook. The IRS can seize refunds, garnish wages, or place liens on jointly owned property.

2. Community Property States

The IRS may consider certain income and property acquired during the marriage as jointly owned even if only one spouse is liable, if you live in a Community property state (like Texas, California, or Arizona).

This means the IRS could target your share of income or assets to satisfy your spouse’s tax debt. Even separate returns might not fully shield you, depending on state rules and how assets are titled.

Ways Tax Debt Can Affect You as a Spouse

Even if you’re not legally responsible for your spouse’s past-due taxes, the IRS can still impact your finances, especially if you’ve merged income or property. Here are the most common ways tax debt causes collateral damage in a marriage:

1. Refund Seizures

If you file a joint tax return, your refund can be seized to cover your spouse’s unpaid IRS or state tax debt, even if you had nothing to do with it.

This is one of the most common surprises married couples face. Fortunately, you may be eligible to reclaim your portion of the refund through the Injured Spouse Allocation process, but only if you file the correct IRS form (Form 8379) and meet eligibility rules.

2. Wage Garnishment

If your spouse’s tax debt is active and unresolved, the IRS can issue a wage garnishment against them (or you), based on your filing status, state property laws, and income sources.

In community property states, even your income may be considered partially available to satisfy your spouse’s debt. If you share a joint business or bank account, the IRS may also target those funds regardless of who earned them.

3. Liens on Jointly Owned Property

If your spouse owes a tax balance, the IRS can place a federal tax lien on any jointly owned real estate, vehicles, or financial accounts. That lien follows the asset and can:

- Block home sales or refinancing

- Reduce your borrowing power

- Create legal complications with other creditors

Even if you’re not the one in debt, your property rights can be frozen until the tax issue is resolved.

4. Levies on Shared Bank Accounts

If you maintain a joint checking or savings account, those funds are at risk of IRS levy, even if the money came entirely from your income.

The IRS doesn’t split hairs. If your name is on the account and your spouse owes, they may levy the full balance unless protective action is taken in time.

5. Stress on Business Partnerships or Household Finances

If you and your spouse run a business together or share operating costs, tax debt can destabilize both. The IRS may:

- Interfere with payroll

- Levy business accounts

- Target income from pass-through entities (like LLCs or S Corps)

Even household financial planning, like saving for a home or college, can become chaotic when the IRS is involved.

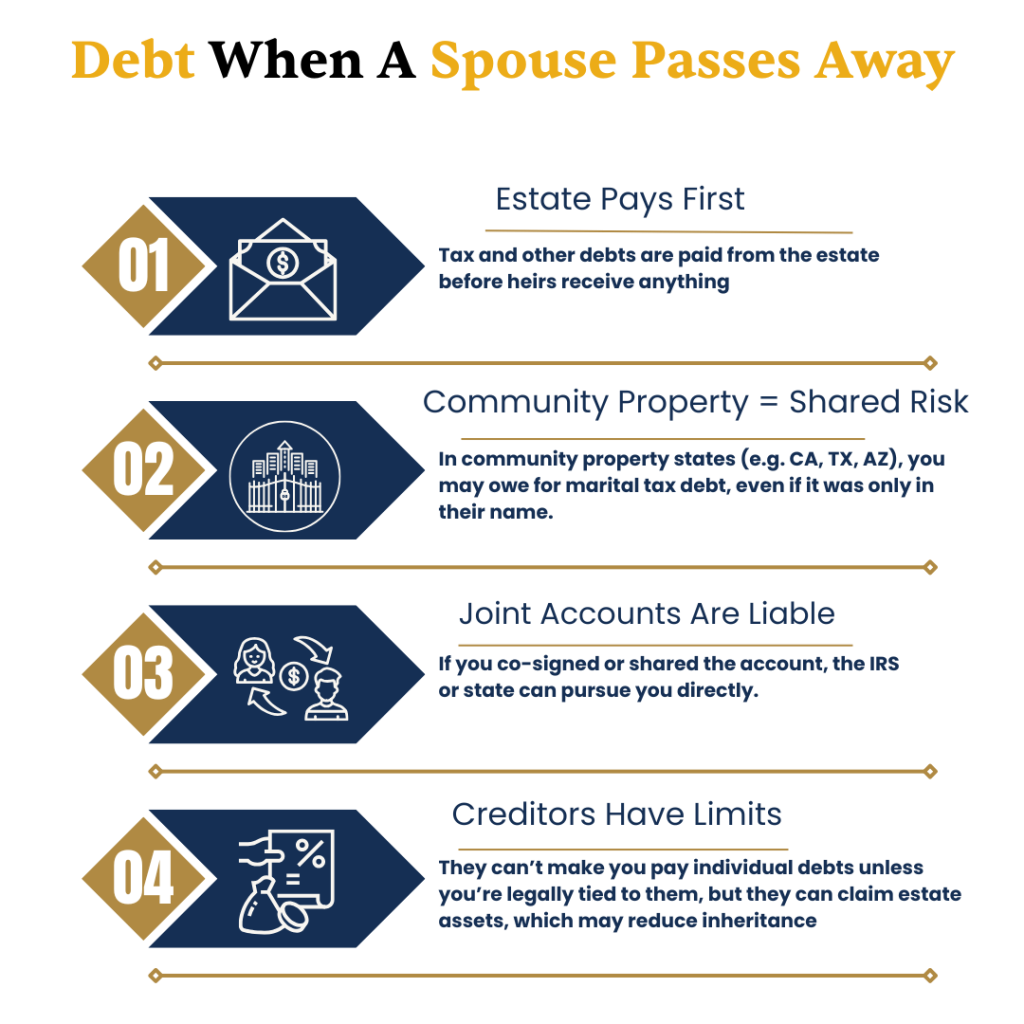

What Happens to Debt If a Spouse Passes Away?

When a spouse dies, the surviving partner is not automatically responsible for the deceased’s debts. But the way those debts are handled depends on several factors:

How to Protect Yourself from a Spouse’s Tax Debt

Whether you’re newly married or planning to tie the knot, taking a few proactive steps can help safeguard both partners from unnecessary debt burdens:

1. Choose Your Filing Status Strategically

Filing a joint return usually comes with tax benefits, but it also brings joint liability. If your spouse owes back taxes, filing jointly could put your refund, wages, or assets at risk.

In contrast, filing as “married filing separately” can help shield you from joint liability, but also increases your tax rate or reduces your deductions. The right decision depends on your situation. Consulting with a tax attorney can help you weigh risk versus reward.

2. Use Innocent Spouse Relief If You’ve Been Unfairly Blamed

If you filed a joint return and are now facing IRS collections because of your spouse’s (or ex-spouse’s) actions, you may qualify for Innocent Spouse Relief.

This IRS program can relieve you from tax, penalties, and interest if you didn’t know—and had no reason to know—about the error or underpayment. It’s a powerful legal tool, but the application process is complex.

J. David Tax Law helps clients across the U.S. file for Innocent Spouse Relief with a high rate of approval. Request a free consultation.

3. Separate Finances Where Appropriate

If your spouse has ongoing tax debt, it’s smart to maintain separate bank accounts and credit lines. This reduces your exposure to IRS levies or lien risks.

- Avoid co-mingling large deposits

- Don’t add your name to accounts the IRS already knows about

- Track household contributions for legal clarity

You can still operate as a team financially, but separation offers critical protection.

4. Understand Community Property Rules

If you live in a community property state, your income and assets may be partially or fully subject to your spouse’s tax obligations even if you file separately.

Learning how your state defines shared income and property can help you proactively limit exposure and structure finances more defensively.

5. Use a Prenuptial or Postnuptial Agreement

Legal agreements don’t shield you from federal collections directly, but they document intent and property ownership, which can help support an Innocent Spouse claim or protect you during a divorce.

Even couples with modest incomes can benefit from clearly defining:

- Whose income is whose

- Who is responsible for specific debts

- What will happen in the case of IRS action

6. Hire a Tax Resolution Attorney If You’re at Risk

If you’ve received an IRS notice, had a refund seized, or suspect a lien is pending, don’t wait. The IRS is aggressive when collecting tax debt, and once enforcement begins, reversing it becomes harder.

J. David Tax Law provides experienced tax resolution services, including:

- Stopping wage garnishments and levies

- Removing IRS liens

- Filing Innocent Spouse and Injured Spouse claims

- Negotiating payment plans or tax settlements

We offer a free, confidential consultation to protect your finances before the IRS makes a move.

Don’t Let Debt Surprise You After “I Do”

Marriage doesn’t automatically mean you inherit your spouse’s debt, but it can affect your financial future in ways many don’t expect. Whether you live in a community property state or not, joint responsibility can arise from shared accounts, co-signing, or how household expenses are paid.

The smart move? Get clarity early. Understand the financial landscape before you tie your finances together. Consult with a tax resolution attorney for free to protect yourself and plan ahead.