Millions of Americans worry that falling behind on taxes could land them behind bars. It’s one of the most common fears when the IRS starts sending letters. Can the IRS really send you to jail just for owing money?

The short answer: not usually. The IRS does not jail people simply for being unable to pay their taxes. But there are serious legal consequences when the IRS believes you willfully avoided your tax responsibilities especially if fraud, false returns, or repeated failure to file is involved.

This guide breaks down exactly when tax debt becomes criminal, how the IRS distinguishes between honest mistakes and fraud, and what steps you can take now to avoid criminal charges or prosecution. If you’re concerned about your tax situation, understanding these distinctions is the first step toward protecting yourself.

Can You Go to Jail for Not Paying Taxes?

The IRS treats non-payment of taxes and tax evasion very differently. If you simply owe money and can’t pay, that alone does not send you to jail. In most cases, the IRS uses civil penalties, including interest, late fees, and liens, to collect unpaid taxes.

But the situation changes when willful neglect or fraud is involved.

Failure to Pay vs. Criminal Evasion

• Failure to pay means you filed your tax return, but didn’t pay the full amount due.

• Tax evasion, on the other hand, involves intentionally avoiding taxes by concealing income, falsifying deductions, or refusing to file returns altogether.

The IRS usually responds to non-payment with financial penalties:

• 0.5% monthly penalty on unpaid tax

• Up to 25% maximum cap

• Interest that compounds daily

But when the IRS believes you’ve acted deliberately, for example, hiding money offshore or fabricating returns, they can pursue criminal charges under IRC §7201 or §7203.

When Jail Becomes a Risk

You could face jail time if:

• You repeatedly fail to file returns

• You ignore IRS enforcement letters

• You’re caught submitting false information or omitting income intentionally

Convictions for criminal tax offenses may lead to:

• Up to 5 years in federal prison per offense

• Fines up to $250,000 (individuals) or $500,000 (corporations)

• Back taxes, penalties, and interest still owed in full

When Not Paying Taxes Turns Criminal

Most people who fall behind on taxes are not criminals. But the IRS treats willful tax violations, not simple mistakes, very seriously. Criminal charges are only pursued when the IRS believes you knowingly broke the law to avoid paying what you owe.

Tax Evasion – IRC §7201

Tax evasion means intentionally trying to avoid paying taxes, such as underreporting income, hiding funds, or using false deductions. The IRS must prove you acted deliberately. If convicted, it’s classified as a felony and can result in prison time, hefty fines, and repayment of the tax owed.

Filing False Returns – IRC §7206

This charge covers knowingly submitting false tax information, even if the fraud didn’t reduce your tax bill. Common examples include inflated deductions or false Social Security numbers. It’s a criminal offense and treated as a felony under IRS law.

Failure to File – IRC §7203

Willfully failing to file required tax returns can also lead to criminal prosecution. While often seen as a minor issue, repeated non-filing or ignoring IRS notices can result in misdemeanor charges and financial penalties.

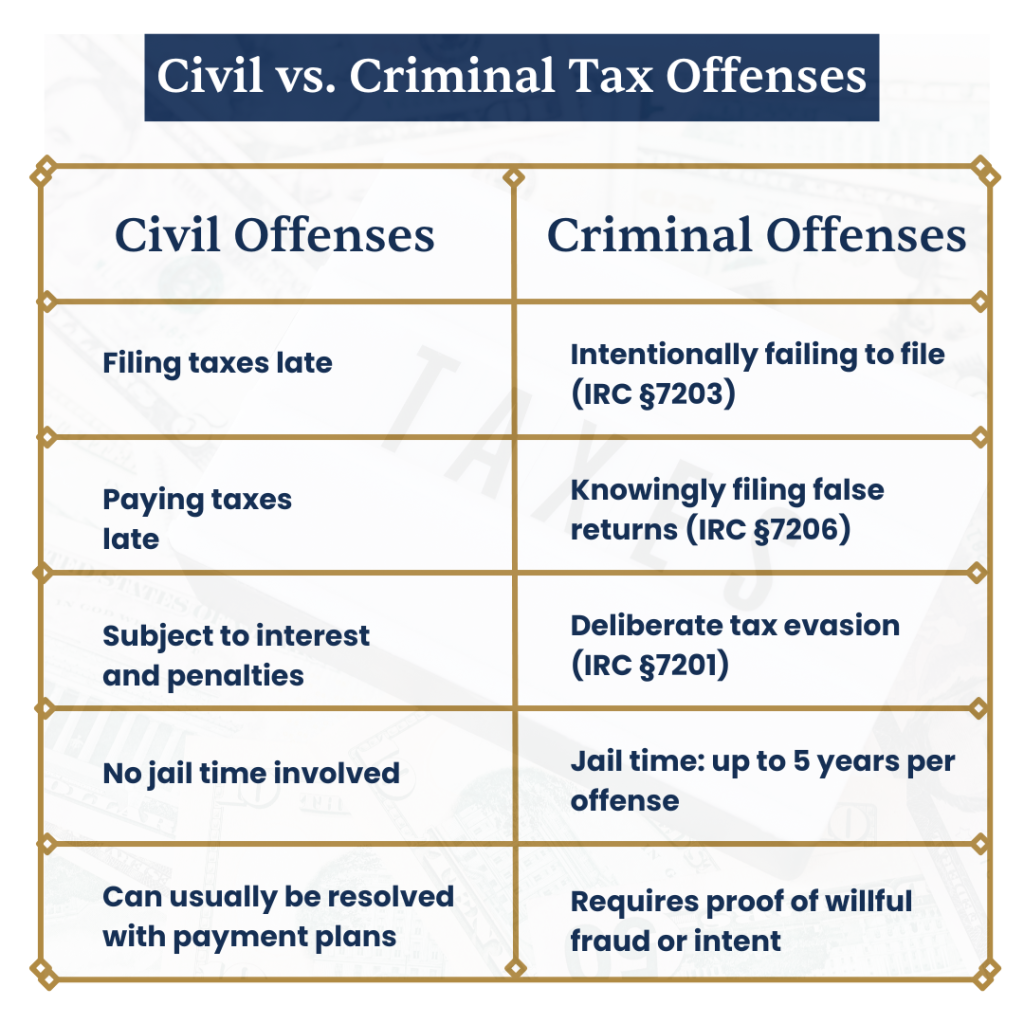

Civil vs. Criminal Tax Penalties

Not every tax mistake results in jail. The IRS uses civil penalties in most cases, especially when errors seem unintentional. Jail becomes a risk only when there’s clear evidence of fraud or willful misconduct.

Here’s how the agency generally responds:

• Failure to Pay Taxes is treated as a civil issue. The IRS applies late-payment penalties and interest until the debt is resolved. Jail is not imposed unless combined with evasion or fraud.

• Failure to File Returns can be civil or criminal. If late filing is seen as deliberate, the IRS may escalate it to a criminal case, especially if returns are missing for multiple years.

• Submitting False Returns is always a criminal matter. The IRS doesn’t need to prove financial gain, only that you knowingly reported false information.

• Tax Evasion involves any deliberate act to avoid taxes and is considered a felony. If proven, the IRS can impose both criminal penalties and civil recovery of back taxes.

Tax Evasion vs. Tax Fraud: What’s the Difference?

Tax evasion and tax fraud are both serious violations, but they aren’t the same. Understanding the difference helps determine the risk level in your situation.

Tax evasion is the act of intentionally avoiding taxes you legally owe. This includes underreporting income, not filing tax returns, or hiding money in offshore accounts. It’s a felony under IRC §7201 and can lead to up to 5 years in prison, plus substantial fines and repayment of the tax debt.

Tax fraud is a broader term that covers any deliberate attempt to mislead the IRS. It includes actions like filing a false return, inflating deductions, or using someone else’s Social Security number. Fraud can be charged under IRC §7206 or §6663, depending on whether it’s pursued civilly or criminally.

The key factor in both is willful intent. The IRS must show that the taxpayer knowingly broke the law, not just made a mistake or filed late. If intent is proven, the consequences can include jail time, fines, and a permanent federal record.

If you’re unsure whether your past filings could raise red flags, now is the time to act. Legal support can often reduce your exposure or resolve the issue before prosecution begins.

Famous Tax Fraud Cases

The IRS rarely sends people to jail for honest tax mistakes, but when fraud is willful and public, prosecution becomes more likely. Several celebrities have made headlines for tax-related convictions, showing how serious the government can get when evasion is blatant.

Wesley Snipes was sentenced to three years in federal prison for willfully failing to file tax returns over multiple years. The court found his conduct deliberate, despite a $5 million payment attempt before sentencing.

Mike “The Situation” Sorrentino, from Jersey Shore, served eight months in prison for tax evasion. He admitted to hiding income and making cash deposits below the reporting threshold to avoid detection.

Ja Rule (Jeffrey Atkins) received a 28-month federal sentence in July 2011 for failing to file tax returns on over $3 million in income during a five-year period.

These cases prove that the IRS is most aggressive when it sees a clear pattern of intentional wrongdoing, especially when the taxpayer ignores multiple chances to resolve the issue. High income, public visibility, and deliberate evasion tend to trigger the harshest penalties.

How the IRS Investigates Tax Crimes

The IRS has a specialized unit called the Criminal Investigation (CI) Division, responsible for handling potential tax crimes. While most IRS enforcement involves civil penalties, CI steps in when there’s evidence of willful misconduct, especially fraud, evasion, or conspiracy to defraud the government.

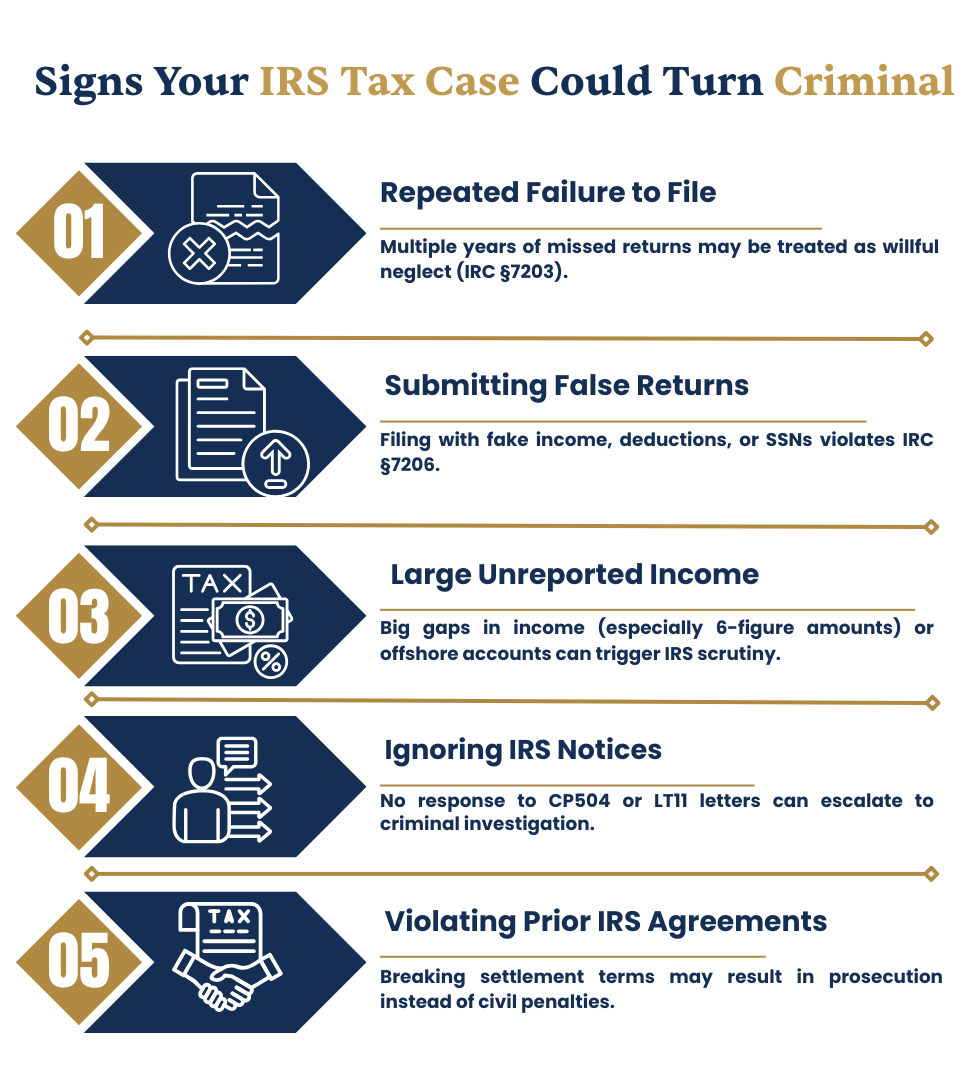

IRS CI investigations are triggered by red flags such as:

• Repeated failure to file tax returns

• Substantial unreported income

• Falsified documents or deductions

• Large unexplained cash transactions

• Use of offshore accounts or shell companies

The process often starts quietly. CI agents collect data from tax filings, banks, third-party sources, and audits. If signs of fraud are strong, the case is elevated to a formal criminal investigation. The taxpayer may not know they’re under review until agents show up with a subpoena, or even execute a search warrant.

Once the investigation is active, CI may work with the Department of Justice (DOJ) to prosecute. They need to prove willful intent, not just error or negligence. If found guilty, the taxpayer could face criminal penalties, including jail time, restitution, and fines.

The IRS only prosecutes a small percentage of taxpayers, but when it does, it makes an example. That’s why it’s critical to respond early to IRS letters and resolve issues before they escalate.

The IRS is Forgiving Millions Each Day. You Could Be Next.

How to Avoid Jail for Tax Issues

The best way to avoid criminal tax charges is to stay compliant, especially when things get tough. Jail typically becomes a risk only when there’s willful neglect or deception. Here’s how to stay on the right side of the IRS:

1. Always File, Even If You Can’t Pay

Failing to file a return triggers much steeper penalties than not paying. Filing shows good faith, even if you don’t have the money. The IRS offers ways to settle later, but they’re less forgiving when you don’t file at all.

2. Set Up a Payment Plan Using Form 9465

If you owe back taxes, an Installment Agreement can help you avoid collection actions. The IRS allows monthly payments, and once you’re in a plan, they typically pause enforcement like levies or garnishments. Applying early shows intent to resolve the debt.

3. Consider an Offer in Compromise (Form 656)

If you truly can’t afford to pay the full balance, an Offer in Compromise (OIC) allows you to settle for less. The IRS reviews your income, assets, and expenses before deciding. Approval is tough but possible, especially if you’re in financial hardship.

4. Request Currently Not Collectible (CNC) Status

If you can’t even afford a payment plan, you may qualify for CNC status. This temporarily stops all IRS collection efforts if you prove you can’t cover basic living expenses. It doesn’t erase the debt, but it protects you from aggressive enforcement.

5. Maintain Records and Respond to Notices

Tax mistakes often start small. Keep thorough documentation of income, deductions, and IRS correspondence. If you receive a notice, respond by the deadline, even if it’s just to ask for more time. Ignoring letters is one of the fastest ways to escalate a civil issue into a criminal one.

Proactivity is your best defense. Whether it’s a missed return or large tax bill, early action can mean the difference between a manageable resolution and serious consequences.

Facing Tax Trouble? Get Legal Help Before It’s Too Late

If you’re behind on taxes, under audit, or worried about IRS enforcement don’t wait until it escalates. Jail time for tax issues is rare, but penalties, interest, and asset seizures are real risks when left unresolved.

At J. David Tax Law®, our IRS tax attorneys know how to stop garnishments, negotiate settlements, and shield you from criminal exposure. Whether you’ve received a Final Notice, owe six figures, or haven’t filed in years, we act fast to protect your income and your rights.

We offer free, confidential consultations and serve clients in all 50 states. You’ll work directly with a licensed attorney, not a case manager or sales rep.

Call (888) 789-5011 now to schedule your free case review. One call can stop IRS action and give you peace of mind.

Conclusion

Failing to meet your tax obligations can lead to serious consequences, but jail is typically reserved for willful violations like tax evasion or fraud. Most cases are handled through civil penalties, such as fines and interest.

Staying informed and addressing tax problems early is the best way to avoid harsh outcomes. Filing on time, keeping accurate records, and seeking professional guidance when needed can help you stay compliant and reduce the risk of further action.