Yes, the IRS can legally seize funds from your 401(k), but it’s rare, and it doesn’t happen without warning. When a taxpayer owes back taxes and ignores repeated collection notices, the IRS has the authority under federal law to levy nearly any asset, including retirement accounts.

However, that power comes with strict limits, and with the right legal intervention, you can often stop the IRS before they touch your retirement savings. Once a levy notice is issued, every day counts. Acting quickly can mean the difference between keeping your 401(k) intact and watching decades of savings disappear into the Treasury.

Key Takeaways

Yes, the IRS can take your 401(k) but only after following strict legal steps.

A Final Notice of Intent to Levy and a 30-day right to a hearing are required before any retirement account seizure can occur.

Certain situations protect your 401(k), including financial hardship, limited withdrawal access, or IRS procedural errors.

A levy on your 401(k) can trigger additional income taxes and early withdrawal penalties, increasing your overall debt burden.

The IRS usually targets a 401(k) only as a last resort after ignored notices, failed payment plans, or repeated noncompliance.

You can prevent or stop a levy by requesting a CDP hearing, applying for an OIC, or securing CNC status.

Can the IRS Garnish or Seize 401(k)?

Yes, the IRS has the power to levy or seize your 401(k) — but it’s usually the last step in a long enforcement process.

When you owe back taxes, the IRS can legally claim property or funds you own, including wages, bank accounts, and in extreme cases, retirement savings. However, unlike wage garnishment or bank levies, retirement account levies are handled with far greater caution and oversight.

Before the IRS touches a retirement account, it must issue several written notices, including a Final Notice of Intent to Levy (Letter 1058) and give you the right to request a Collection Due Process (CDP) hearing. These steps exist to protect taxpayers from wrongful or premature seizure, and they give you time to act.

Most taxpayers who receive levy threats on their 401(k)s can still avoid asset loss by contacting a tax attorney early. Once a levy is issued, it becomes much harder but not impossible to reverse.

At What Point Can the IRS Take 401(k)?

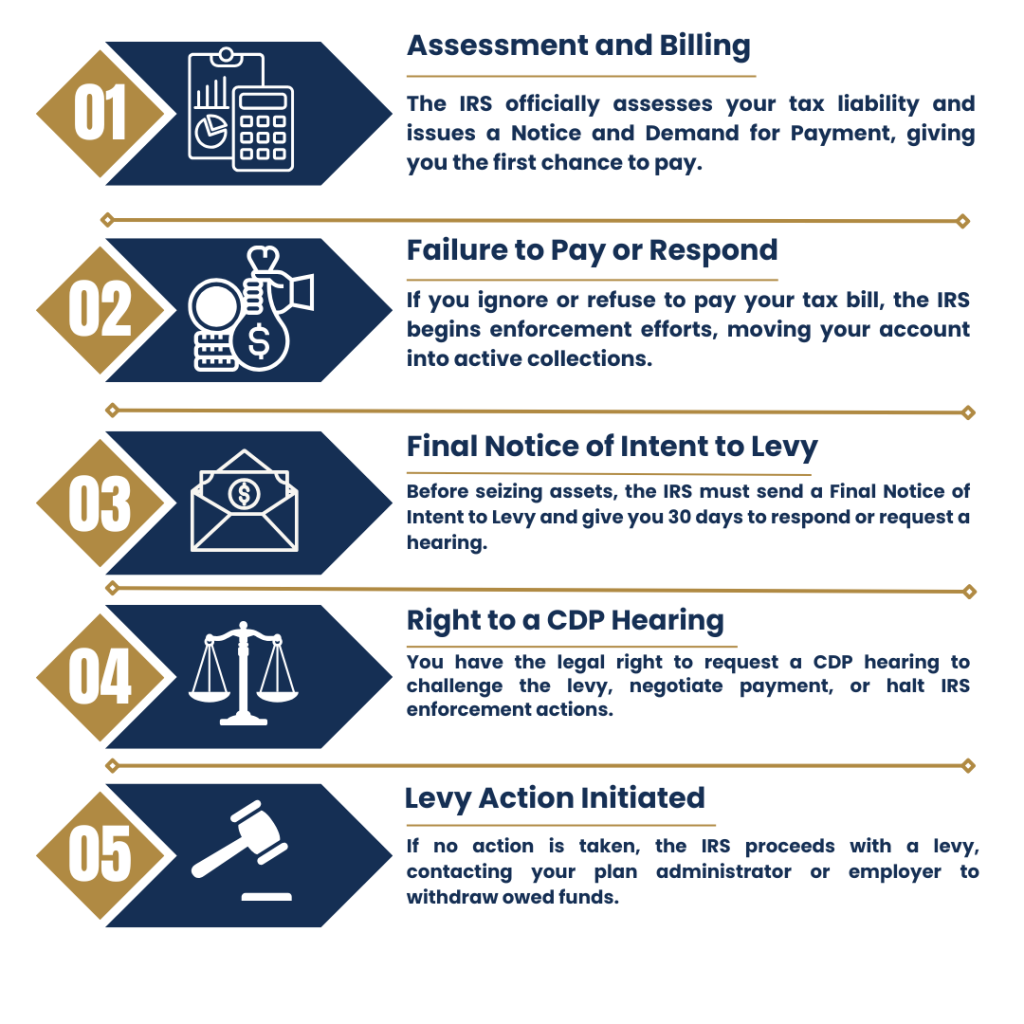

The IRS can move forward with a levy on your retirement account only if all of the following have occurred:

You received a tax bill (Notice and Demand for Payment) from the IRS outlining what you owe.

You neglected or refused to pay the outstanding balance in full or set up an approved payment plan.

The IRS sent you a Final Notice of Intent to Levy (Letter 1058) and a Notice of Your Right to a Hearing at least 30 days before taking your assets.

If those three conditions are satisfied and you take no action, the IRS can instruct your 401(k) plan administrator to withdraw funds to satisfy your tax debt.

This process, however, is not automatic, and it’s rarely the IRS’s first move. A levy on a retirement account is considered a last resort, often used only when a taxpayer ignores all other collection attempts.

The IRS is Forgiving Millions Each Day. You Could Be Next.

The Legal Basis for the Government to Take Your 401(k)

The IRS’s authority to seize a taxpayer’s assets, including funds in a 401(k), comes from Section 6331 of the Internal Revenue Code (IRC). This statute gives the government the legal power to collect unpaid federal taxes through a process known as a tax levy.

Under this law, if you fail to pay your tax debt after proper notice and demand, the IRS may “collect such tax by levy upon all property and rights to property” belonging to you or held on your behalf. In plain terms, that means the IRS can legally take assets such as bank funds, wages, or, in certain situations, retirement savings — even if those assets are intended for future use.

However, this authority comes with strict procedural limits and taxpayer rights. Before touching your 401(k), the IRS must:

Verify that all notice requirements were met (including the Final Notice of Intent to Levy).

Determine that the retirement account is not exempt under IRC §6334, which protects certain types of benefits and pensions.

Ensure that the levy action complies with federal collection guidelines and does not cause undue hardship.

Which Types of Retirement Accounts Can the IRS Seize?

While the IRS can legally levy many types of assets, not all retirement accounts are treated the same. Some are fully subject to levy under federal law, while others may be partially protected depending on how and when funds are accessed.

According to Internal Revenue Code §6334 and IRS collection procedures, the following general rules apply:

401(k) Plans

Traditional and Roth IRAs

SEP and SIMPLE IRAs

Pension Plans

Social Security Benefits

It’s important to understand that the IRS cannot seize funds you don’t yet have access to.

For example, if your 401(k) prohibits withdrawals until retirement or termination of employment, the IRS may wait until those funds become accessible.

When the IRS Cannot Take Your 401(k)?

Even though the IRS has broad authority to collect unpaid taxes, there are specific limits and exemptions that protect taxpayers from losing all of their retirement savings. The agency cannot freely seize a 401(k) in every situation — and in many cases, your account may be temporarily or permanently shielded from levy.

Here are key situations where your 401(k) is generally protected:

You do not have access to withdraw funds. If your 401(k) is still tied to an active employer and you can’t make voluntary withdrawals, the IRS usually cannot levy it until you leave that employer or reach withdrawal eligibility.

You’re under financial hardship. If seizing your 401(k) would prevent you from meeting basic living expenses — like housing, utilities, and medical care — the IRS may classify your account as Currently Not Collectible (CNC) and delay or stop enforcement.

The IRS didn’t follow proper notice procedure. If the IRS failed to issue the required Final Notice of Intent to Levy and Notice of Your Right to a Hearing, any subsequent levy could be considered invalid and subject to release.

Part of the account is exempt under law. Some government, military, or Railroad Retirement benefits are protected in whole or part from IRS collection.

If you’ve received a levy warning or demand letter, don’t assume your retirement is automatically at risk. Our Tax Levy attorney can help you assert your exemptions, challenge procedural errors, and create a resolution that keeps your 401(k) intact.

How the IRS Levy Process Works: Step-by-Step Guide

Understanding how an IRS levy unfolds is key to stopping it before it reaches your 401(k). The process follows a defined legal sequence outlined in IRS Publication 594 and IRC §6331, ensuring that taxpayers receive notice and an opportunity to resolve their debt before assets are seized. Here’s how the process typically works:

Will I Face Additional Taxes or Penalties from the 401(k) Levy?

Yes, in many cases, a 401(k) levy can trigger additional taxes and penalties beyond what you already owe the IRS. When the agency seizes funds from a retirement account, that withdrawal is treated as a taxable distribution, meaning it can increase your income for the year and lead to new tax liabilities.

Here’s what typically happens:

Early Withdrawal Penalty: If you’re under age 59½, the IRS generally imposes a 10% early withdrawal penalty on top of the amount taken.

Income Tax Liability: Because 401(k) funds are pre-tax contributions, any amount withdrawn by the IRS is considered ordinary income and is subject to federal income tax.

State Tax Implications: Depending on where you live, state income tax may also apply to the levied amount, adding to the overall financial impact.

The result is a double hit: your retirement balance decreases, and your tax burden may rise in the same year the levy occurs. This is why it’s important to intervene before the IRS reaches your 401(k).

How to Protect Your 401(k) from an IRS Tax Levy

The best way to protect your 401(k) from the IRS is to act before a levy is issued. Once the IRS contacts your retirement plan administrator, reversing the process becomes much more difficult, and in some cases, impossible. The key is to show the IRS that you are actively working toward resolution of your tax debt.

Installment Agreement

An Installment Agreement is a payment plan that allows you to repay your tax debt in manageable monthly amounts. Once it’s approved, IRS collection activity, including levies, is suspended as long as you remain compliant. This option is ideal if you can afford steady payments without financial strain.

Offer in Compromise (OIC)

An Offer in Compromise lets you settle your tax debt for less than what you owe if you can prove paying in full would cause financial hardship. The IRS reviews your income, assets, and expenses before approval. A successful OIC can permanently stop a levy and resolve your debt at a fraction of the balance.

Currently Not Collectible (CNC) Status

If you’re unable to pay any amount without sacrificing basic living needs, you may qualify for CNC status. This temporarily halts all IRS collection efforts, including levies, while your financial situation stabilizes. The debt remains, but the IRS cannot legally seize your 401(k) during the CNC period.

Collection Due Process (CDP) Hearing

At J. David Tax Law, our attorneys specialize in stopping IRS levies, often within 48 hours, and securing long-term protection for your assets. Your retirement took decades to build; we can help ensure it isn’t lost to the IRS. Call us at (888) 342-9436 for a free consultation today!

Common Mistakes That Can Trigger an IRS 401(k) Levy

The IRS rarely targets retirement accounts unless a taxpayer repeatedly ignores opportunities to resolve their debt. Knowing what triggers enforcement can help you stay protected.

Here are the behaviors that often lead to a 401(k) levy:

Ignoring IRS Notices and Letters

Defaulting on a Payment Plan

Failing to File Tax Returns

Delaying Professional Help

Conclusion

The IRS does have the authority to levy your 401(k), but that power comes with strict legal limits and procedural safeguards. A levy is never the first step; it’s the result of unresolved tax debt, ignored notices, and lost opportunities to act early. By recognizing the warning signs, communicating with the IRS, and using the relief options available—such as Installment Agreements, Offers in Compromise, or Currently Not Collectible status—most taxpayers can prevent the IRS from ever reaching their retirement funds.

If you’re facing IRS collection threats or have received a levy notice, don’t wait. J. David Tax Law can help you protect your 401(k), stop enforcement, and negotiate a lasting solution. Call (888) 342-9436 or request your free confidential consultation today.